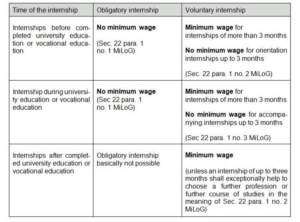

With few exceptions, the German Minimum Wage Act (Mindestlohngesetz/”MiLoG”) provides for the right to a minimum wage since January 1, 2015. The minimum wage covers almost every sector and type of employment (including part-time and full-time employment, mini-jobs and most internships). The current amount of the minimum wage is 8.50 Euro gross per hour.

General Rule

As a general rule, interns are entitled to the minimum wage as well, unless one of the exceptions defined in the Act applies.

Caution – an intern is not necessarily an intern: The activity of an intern is supposed to grant practical knowledge and experience for a specific occupation. If the intern is working in areas that are not related to the desired occupation and carries out the same work as “regular” employees, there is a certain risk that he will legally be qualified as a “regular” employee, who is at least subject to the minimum wage. It may even be – depending on the circumstances of the individual case – that the employee is entitled not only to receive the minimum wage but an adequate remuneration according to Sec. 612 para. 1 German Civil Code (Bürgerliches Gesetzbuch/”BGB”). This means that the employer has to pay the usual remuneration to be expected for the performed work which is often higher than the minimum wage (cf. also Federal Labor Court (Bundesarbeitsgericht/BAG), February 10, 2015 – 9 AZR 289/13).

Exceptions for interns

The minimum wage does not apply to the following four internship-categories:

- “Obligatory internship” (Pflichtpraktika“, Sec. 22 para. 1 no. 1 MiLoG): Internships which are obligatory pursuant to educational regulations, vocational training ordinances, higher educational regulations, or if they are a mandatory part of a course at a vocational training institution (Berufsakademie), are exempt from the Minimum Wage Act’s scope. Maximum time-limits for the duration of obligatory internships do not exist.

- “Voluntary orientation internship” (“Freiwillige Orientierungspraktika“, Sec. 22 para. 1 no. 2 MiLoG): Internships of up to 3 months which shall serve as orientation with regard to the choice of a vocational training or of studies at a higher educational institution are exempt from the Minimum Wage Act’s scope.

Caution – It is most likely that the minimum wage will have to be paid from day one on if the maximum period of three months is exceeded. - “Voluntary accompanying internship” (“Freiwillige ausbildungsbegleitende Praktika“, Sec. 22 para. 1 no. 3 MiLoG): Internships of up to 3 months which accompany vocational training or higher education of the intern, unless such an internship had already been established with the same employer at some time in the past, are exempt from the Minimum Wage Act’s scope.

Caution – It is most likely that the minimum wage will have to be paid from day one on if the maximum period of three months is exceeded.

- “Entry-level qualification” (“Einstiegsqualifizierung“, Sec. 22 para. 1 no. 4 MiLoG): Internships which are intended as an entry-level qualification pursuant to Sec. 54a Social Security Code chapter III (Sozialgesetzbuch Drittes Buch/SGB III) or a vocational preparation pursuant to Sec. 68 to 70 of the Vocational Training Act (Berufsbildungsgesetz/BBiG) are exempt from the Minimum Wage Act’s scope.

Interncheck – Overview

PLEASE NOTE: The Minimum Wage Act still contains some ambiguities. It will be up to the labor courts to interpret the Minimum Wage Act. This publication provides information and comments on legal issues and developments. It is not a comprehensive treatment of the subject matter covered and should not be used as a substitute for taking legal advice in individual cases.

(25 January 2016)