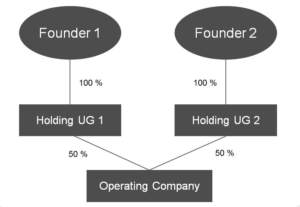

It’s common among founders and investors to establish a so-called Doppelstockmodell (two-tier model). Here, the founder or investor does not directly own shares in the operating company/target, but establishes a personal holding company that owns them. The Unternehmergesellschaft (UG) is relatively quick and easy to set up, making it the preferred legal entity for such a holding company.

Chart: Structure of the Doppelstockmodell:

Advantages

Tax benefits are the primary reason for creating such a Doppelstockmodell. At the holding company level, 95 percent of a stock sale’s earnings (exit) are tax exempt. The same exemption applies to dividends, however only if the holding company owns at least 10 percent of the shares in the operating company – this due to a legislative change in March 2013.

By contrast, an investor/founder with direct ownership of shares in the operating company faces a tax liability of up to 27 percent (plus Solidaritätszuschlag (solidarity tax) and possible church taxes) on a stock sale’s earnings (so-called Teileinkünfteverfahren), and up to 25 percent (plus solidarity tax and possible church taxes) on dividend payments (capital gains tax).

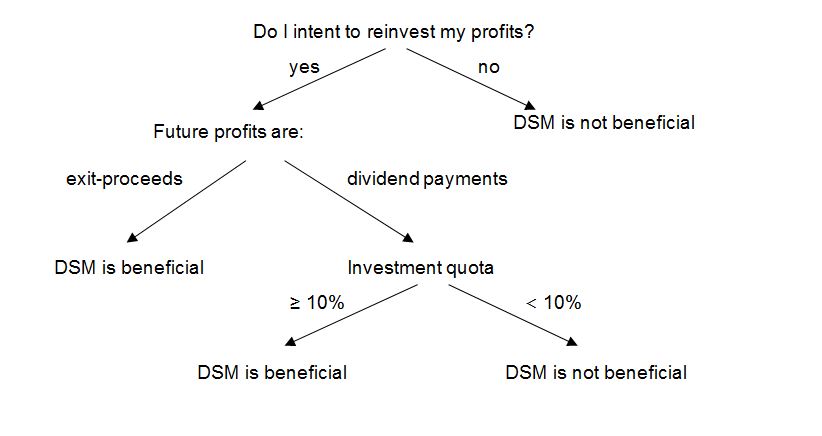

The Doppelstockmodell does not suit every situation. The founder/investor should ask two questions when deciding whether to establish a holding company.

-

Will profits be reinvested?

The Doppelstockmodell only makes sense if the founder/investor intends to reinvest profits and does not require them for short-term, personal expenditures.

When shares are held by a holding company, only the holding company initially takes earnings from dividends or the sale of the shares. Therefore, only the holding company has tax liability. Assuming dividends or earnings are derived from at least a 10 percent stake, such earnings are up to 95 percent tax exempt, thus allowing the holding company to reinvest nearly all profit in the operating company.

If, however, earnings are to be passed from holding company to founder/investor, the holding company must, in turn, distribute the profits as dividends. This triggers tax liability (so-called cascade effect) without the tax-exempt status, because the founder/investor is a natural person, not a legal entity. In this case, the founder/investor would have to pay up to 25 percent in taxes on the dividends (plus solidarity tax and possible church taxes).

In this regard, the Doppelstockmodell becomes a tax deferral rather than a tax exemption. Additionally, the two-tier model could result in double taxation – first on holding company level, then again for the founder/investor). This is a risk in particular should the holding company be exempted from tax-exempt benefits, such as for dividend payments on a free-float (less than 10 percent) share.

2. Exit proceedings or dividend payments?

In particular with startups, which initially generate little, if any profit, the reason to invest is mainly to profit from a future sale of shares. Here, the Doppelstockmodell is an advantage. Exit proceeds at the holding company level are always 95 percent tax exempt, regardless of the shareholding quota.

This may not be the case if the operating company makes considerable dividend payments. The tax exemption applies only if the holding company owns at least 10 percent of the operating company. Dividends on a free-float share are therefore fully taxable. The two-tier model is not recommended in this case, and the founder/investor should directly hold shares in the operating company. It is important to note that an initial stake in the operating company of 10 percent or more can be quickly diluted below the quota threshold over the course of further financing rounds.

Current Developments

The German Federal Ministry of Finance (BMF) recently proposed reforming corporate tax regulations in the interest of equal taxation of exit proceeds and dividend payments. An investment taxation draft dated 21 July 2015 included an amendment that stripped the relevant clause in the Corporate Tax Act (KStG) of the tax exemption applied to exit proceeds of a free-float share (<10 percent). Had the amendment been adopted, it would have led to an equally disadvantageous tax liability for both exit proceeds and dividend payments from a free-float share, rendering the Doppelstockmodell unattractive for founders or investors with a present or future ((e.g. by dilution) stake of less than the 10 percent threshold.

The draft was, however, roundly criticized, and the BMF abandoned its reform plans, at least for the time being. The current investment taxation draft, dated 16 December 2015, no longer includes such an amendment to the Corporate Tax Act, but it remains to be seen if the BMF will make a second attempt to insert it. Additional developments should be observed closely to ensure the appropriate business measures are taken in a timely manner.

Summary

The Doppelstockmodell still offers material tax advantages for founders/investors whose investment focus is on exit proceeds from, and reinvesting profit in, the operating company. The establishment of a holding company does not make sense when the founder/investor is interested in taking immediate or short-term profits out of the operating company. In this case, the founder/investor should hold shares directly.

Chart: When to use the Doppelstockmodell (“DSM”)

(15 June 2016)